Intercontinental Exchange (ICE)

168.29

+0.00 (0.00%)

NYSE · Last Trade: Feb 6th, 8:40 AM EST

In a move that signals the complete integration of digital assets into the global financial architecture, CME Group (NASDAQ: CME) has announced the expansion of its cryptocurrency derivatives suite to include Cardano (ADA), Chainlink (LINK), and Polkadot (DOT). The launch, set to take place on February 9, 2026, is paired

Via MarketMinute · February 5, 2026

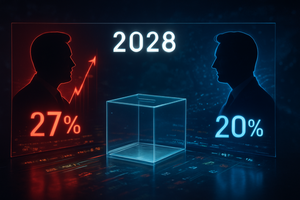

While the dust of the 2024 election cycle has barely settled, the financial world is already placing its bets on the next battle for the White House. As of February 2026, prediction markets—the once-niche platforms that successfully forecasted the 2024 outcome with surgical precision—are signaling a clear trajectory for the 2028 U.S. Presidential Election. Vice [...]

Via PredictStreet · February 5, 2026

Intercontinental Exchange Inc (NYSE:ICE) Edges Past Q4 2025 Estimates, Provides Measured 2026 Outlookchartmill.com

Via Chartmill · February 5, 2026

As the Federal Reserve's March 2026 meeting approaches, a striking divergence has emerged between traditional financial instruments and the burgeoning world of "Information Finance." On Kalshi, the federally regulated prediction market, traders are increasingly convinced that the central bank will pivot toward easing. Currently, 64% of participants on the platform are betting on a 25-basis-point [...]

Via PredictStreet · February 5, 2026

The global financial landscape has shifted into a new era of "Information Finance," or InfoFi, where the most valuable commodity is not gold or oil, but the "truth." As of February 5, 2026, the battle for dominance in this sector has narrowed down to two titans: Polymarket, the decentralized, crypto-native pioneer, and Kalshi, the regulated, [...]

Via PredictStreet · February 5, 2026

The prediction market industry has officially shed its label as a niche corner of the internet for political junkies and sports bettors. As of early February 2026, the sector is celebrating a watershed moment: total trading volume surpassed a staggering $45 billion in 2025, a nearly five-fold increase from the previous year. This momentum shows [...]

Via PredictStreet · February 5, 2026

ICE Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 5, 2026

Global market infrastructure company Intercontinental Exchange (NYSE:ICE) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 35.3% year on year to $3.14 billion. Its non-GAAP profit of $1.71 per share was 2.2% above analysts’ consensus estimates.

Via StockStory · February 5, 2026

Global market infrastructure company Intercontinental Exchange (NYSE:ICE) will be reporting earnings this Thursday before market open. Here’s what to expect.

Via StockStory · February 3, 2026

SiteOne Landscape Supply distributes a broad range of landscape products to professional customers across North America.

Via The Motley Fool · February 3, 2026

BellRing Brands markets protein shakes and powders through Premier Protein and Dymatize, serving health-conscious consumers globally.

Via The Motley Fool · February 3, 2026

Serving bookmakers and media worldwide, Sportradar delivers sports data, analytics, and streaming solutions across the betting value chain.

Via The Motley Fool · February 3, 2026

The concept of "Information Finance," or InfoFi, has transitioned from a niche crypto-economic theory into a foundational pillar of global finance and media. As of February 2, 2026, prediction markets are no longer viewed as mere platforms for speculation; they have been repositioned as sophisticated data-transmission mechanisms that assign a market price to the accuracy [...]

Via PredictStreet · February 2, 2026

As the calendar turns to February 2026, the United States is bracing for a political showdown that promises to be as much a financial event as a democratic one. The 2026 U.S. Midterm Elections are already generating unprecedented activity in the prediction market space, with traders pouring billions of dollars into contracts determining the future [...]

Via PredictStreet · February 2, 2026

The prediction market landscape was forever altered on January 2, 2026, by what traders are now calling the "January 2nd Shockwave." While the industry has long flirted with mainstream relevance, this single day of unprecedented institutional-sized trades—triggered by a geopolitical "black swan" and a massive injection of Wall Street capital—has cemented prediction markets as the [...]

Via PredictStreet · February 2, 2026

Polymarket, the prediction market platform that dominated the 2024 global news cycle, has officially entered its next act. In a bold strategic shift finalized in January 2026, the platform has transitioned from a fee-free information hub into a revenue-generating financial infrastructure. This move is headlined by the introduction of up to 3% "taker fees" on [...]

Via PredictStreet · February 2, 2026

As of early February 2026, the financial world has officially crossed the Rubicon. Prediction markets, once relegated to the fringes of internet forums and academic theory, have fully integrated into the DNA of the global financial system. The tipping point arrived not with a single event, but through a series of massive institutional migrations that [...]

Via PredictStreet · February 2, 2026

The landscape of global finance reached a definitive turning point in late 2025, as prediction markets shed their reputation as "crypto-native niches" to become a cornerstone of the institutional financial stack. This transformation was signaled most loudly by the Intercontinental Exchange (NYSE: ICE), the parent company of the New York Stock Exchange, which finalized a [...]

Via PredictStreet · February 1, 2026

The dawn of 2026 has marked a definitive shift in the global financial ecosystem: prediction markets are no longer the exclusive playground of crypto-native speculators and data scientists. What was once a niche corner of the internet, often viewed with regulatory skepticism, has been institutionalized. Today, the "Wall Street Takeover" of prediction markets—now increasingly referred [...]

Via PredictStreet · February 1, 2026

The prediction market landscape has officially entered its most volatile and high-stakes era yet. Following a staggering 2025 that saw over $40 billion in total trading volume, the industry is now locked in what analysts are calling the "Great Prediction War." This isn't just a race for market share; it is a fundamental clash between [...]

Via PredictStreet · February 1, 2026

Tesla's robotaxis are finally driving without a safety driver in the front seat, so we're discussing future business models for Tesla, and also Greg Abel making a mark on Berkshire Hathaway, Apple's chatbot, and 24/7 trading.

Via The Motley Fool · January 30, 2026

As of January 30, 2026, the way we consume news on X (formerly Twitter) has undergone a fundamental shift. No longer just a scroll of opinions and viral clips, the platform has transformed into what analysts are calling an "Information Finance" (InfoFi) engine. The cornerstone of this transformation is the seamless integration of live prediction [...]

Via PredictStreet · January 30, 2026

As the prediction market industry enters its most ambitious year to date, a single contract on Manifold Markets has emerged as the definitive "North Star" for traders, regulators, and venture capitalists alike. The contract—"Which Prediction Market will have the highest total USD-equivalent trading volume in 2026?"—is currently trading with Polymarket as the 47% favorite, followed [...]

Via PredictStreet · January 30, 2026

As the calendar turns to January 30, 2026, the global financial eye has shifted from the traditional exchanges of Wall Street to the high-stakes digital arenas of prediction markets. The primary catalyst is the 2026 U.S. Midterm Elections, which have rapidly ascended to become the most significant volume driver in the history of the forecasting [...]

Via PredictStreet · January 30, 2026

As we enter the first quarter of 2026, a fundamental shift is occurring in the architecture of global finance. For decades, institutional trading desks relied on the "terminal" model—terminal data from legacy providers, consensus surveys, and government reports—to price risk. Today, that hierarchy has been inverted. Algorithmic trading bots are no longer just participants in [...]

Via PredictStreet · January 30, 2026