Deere & Co (DE)

574.48

+8.75 (1.55%)

NYSE · Last Trade: Feb 6th, 10:46 AM EST

Detailed Quote

| Previous Close | 565.73 |

|---|---|

| Open | 568.00 |

| Bid | 573.96 |

| Ask | 575.00 |

| Day's Range | 567.55 - 580.00 |

| 52 Week Range | 404.42 - 574.94 |

| Volume | 293,577 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 6.480 (1.13%) |

| 1 Month Average Volume | 1,508,667 |

Chart

About Deere & Co (DE)

Deere & Company is a prominent manufacturer of agricultural, construction, and forestry equipment, renowned for its iconic green and yellow machinery. The company provides a wide range of products including tractors, harvesters, and engines, as well as precision agriculture technologies that enhance farming efficiency and productivity. In addition to equipment, Deere offers financial services and supports sustainable practices in agriculture. With a commitment to innovation, the company plays a crucial role in advancing modern farming and construction capabilities, serving customers globally. Read More

News & Press Releases

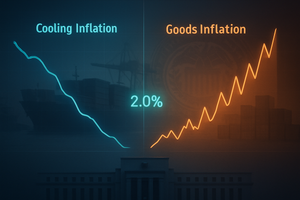

As of February 6, 2026, the American economy finds itself in a precarious balancing act. The "Liberation Day" tariffs, a cornerstone of the current administration’s trade policy, have successfully reshaped supply chains but at a significant cost: "sticky" goods inflation. While services inflation has largely cooled, the persistent rise

Via MarketMinute · February 6, 2026

The latest Personal Consumption Expenditures (PCE) price index data has revealed a significant shift in the U.S. inflationary landscape, presenting a complex puzzle for the Federal Reserve. As of early February 2026, the data shows a stark divergence: while the services sector—the primary engine of post-pandemic inflation—is

Via MarketMinute · February 6, 2026

Agricultural markets are entering a period of profound uncertainty as a confluence of surging input costs, volatile weather patterns, and shifting geopolitical alliances threaten to destabilize global food security. Despite a period of relative stabilization throughout 2025, early data from February 2026 suggests the "calm" is rapidly evaporating. According to

Via MarketMinute · February 6, 2026

As of February 6, 2026, the agricultural sector finds itself at the center of a high-stakes tug-of-war between digital diplomacy and physical market fundamentals. This week, the soybean market transformed into a volatile arena where a single social media post from President Donald Trump managed to erase weeks of bearish

Via MarketMinute · February 6, 2026

The United States agricultural sector is witnessing a historic resurgence in international demand, with corn export volumes skyrocketing by 33% over the past year. Driven by a record-breaking 17.02 billion bushel harvest in late 2025, American growers are successfully reclaiming global market share, navigating a complex landscape of shifting

Via MarketMinute · February 5, 2026

The global agricultural market experienced a seismic shift this week as soybean futures on the Chicago Board of Trade witnessed a massive surge, gapping higher by nearly 50 cents in a technical breakout. The catalyst for the rally was a high-stakes social media announcement from President Donald Trump, who detailed

Via MarketMinute · February 5, 2026

Luxembourg, February 5, 2026 - ArcelorMittal (referred to as “ArcelorMittal” or the “Company” or the "Group") (MT (New York, Amsterdam, Paris, Luxembourg), MTS (Madrid)), the world’s leading integrated steel and mining company, today announced results1 for the three-month and twelve-month periods ended December 31, 2025

By ArcelorMittal S.A. · Via GlobeNewswire · February 5, 2026

The Relative Strength (RS) Rating for Deere stock entered a higher percentile Wednesday, as it got a lift from 68 to 71.

Via Investor's Business Daily · February 4, 2026

3 February 2026, 14:30 CET

By ArcelorMittal S.A. · Via GlobeNewswire · February 3, 2026

The stocks featured in this article are seeing some big returns.

Over the past month, they’ve outpaced the market due to some combination of positive news, upbeat results, or supportive macro developments. As such, investors are taking notice and bidding up shares.

Via StockStory · February 2, 2026

The U.S. manufacturing sector received a significant shot of confidence on January 29, 2026, as the Census Bureau released data for November 2025 showing a robust 1.7% rise in factory orders. This increase, which met and in some segments exceeded analyst expectations, suggests that the American industrial base

Via MarketMinute · February 2, 2026

The U.S. economy faced a sobering reality check last week as the Bureau of Economic Analysis (BEA) released a trade report on January 29, 2026, revealing a deficit that widened far beyond initial expectations. While economists had penciled in a consensus forecast of -$43.4 billion, the final

Via MarketMinute · February 2, 2026

The global grain markets are facing a sobering start to February 2026, as a relentless wave of supply from the Americas continues to crush commodity prices and dampen the outlook for the agricultural sector. On Monday, February 2, 2026, grain futures extended their recent slide: Wheat led the retreat with

Via MarketMinute · February 2, 2026

The global commodities market is bracing for a significant downturn as the World Bank’s latest Commodity Markets Outlook warns of a looming 7% price decline in 2026. This projected drop would mark the fourth consecutive year of falling prices, eventually bottoming out at a six-year low. The forecast is

Via MarketMinute · February 2, 2026

Tianjin Power Machinery Co., Ltd., a prominent manufacturing enterprise with over 30 years of industry experience, is pleased to announce the launch of its new support part tailored for New Holland small Square Baler s. This high-quality replacement part, designated as New Holland 86977213 (also known as 9604508 SUPPORT), serves as a direct replacement for the part number 89604508, delivering reliable performance for a wide range of New Holland baler models including the popular BC5060, BC5070, and 570 series.

Via AB Newswire · February 2, 2026

Samsara's stock had a rough go of things in 2025, despite the fact that the company is growing fast and operates in a fast-growing industry.

Via The Motley Fool · February 1, 2026

The industrial sector faced a harsh reality check this week as United Rentals (NYSE: URI), the world’s largest equipment rental company, saw its shares dive by nearly 13% following the release of its fourth-quarter earnings and a surprisingly cautious revenue forecast for 2026. Despite coming off a record-breaking 2025,

Via MarketMinute · January 30, 2026

The agricultural world is still reeling from the "major shock" delivered by the U.S. Department of Agriculture (USDA) in its January 2026 Crop Production report. Released earlier this month, the data confirmed what many feared but few expected: a massive supply glut that has fundamentally reset the price floor

Via MarketMinute · January 30, 2026

30 January 2026, 08:30 CET

By ArcelorMittal S.A. · Via GlobeNewswire · January 30, 2026

29 January 2026, 14:00 CET

By ArcelorMittal S.A. · Via GlobeNewswire · January 29, 2026

As the 2026 tax filing season begins, the American economy is navigating a radical transformation defined by Treasury Secretary Scott Bessent’s "non-inflationary boom" strategy. This ambitious economic experiment, centered on the "One Big Beautiful Bill" (OBBB)—officially the Working Families Tax Cut Act—represents the most significant shift in

Via MarketMinute · January 28, 2026

President Donald Trump revealed plans on Tuesday for a new John Deere facility from parent company, Deere & Co. (NYSE: DE) in the United States.

Via Benzinga · January 28, 2026

The release of soft manufacturing sector data in early March 2025 has sent shockwaves through global financial markets, transforming early-year optimism into a profound "recession scare." As the Institute for Supply Management (ISM) and S&P Global published their respective Purchasing Managers' Indices (PMI), investors were confronted with a dual-threat

Via MarketMinute · January 27, 2026

The sovereign bond market sent a clear signal to Washington and Wall Street this month as the benchmark 10-year Treasury yield surged to a multi-month high of 4.29% on January 20, 2026. This sharp move upward reflects a growing consensus among investors that the Federal Reserve may be physically

Via MarketMinute · January 26, 2026