NVIDIA Corp (NVDA)

171.88

+0.00 (0.00%)

NASDAQ · Last Trade: Feb 6th, 4:42 AM EST

Detailed Quote

| Previous Close | 171.88 |

|---|---|

| Open | - |

| Bid | 175.30 |

| Ask | 175.39 |

| Day's Range | N/A - N/A |

| 52 Week Range | 86.62 - 212.19 |

| Volume | 360,679 |

| Market Cap | 4.18T |

| PE Ratio (TTM) | 42.54 |

| EPS (TTM) | 4.0 |

| Dividend & Yield | 0.0400 (0.02%) |

| 1 Month Average Volume | 170,042,438 |

Chart

About NVIDIA Corp (NVDA)

NVIDIA Corporation is a leading technology company primarily known for its innovations in graphics processing units (GPUs) that enhance visual computing across various applications, including gaming, professional visualization, and artificial intelligence. Beyond its strong presence in gaming, NVIDIA's products are integral to deep learning and data center solutions, empowering advancements in machine learning, autonomous vehicles, and high-performance computing. By leveraging its cutting-edge technologies, NVIDIA aims to drive the future of computing and improve experiences across industries, from entertainment to scientific research. Read More

News & Press Releases

A trio of low-cost exchange-traded funds (ETFs) account for three of the 10 most-held securities by Robinhood's retail investors.

Via The Motley Fool · February 6, 2026

OpenAI alone wants to spend $1.4 trillion on AI infrastructure, which means there's a lot of money on the table for these three companies in particular.

Via The Motley Fool · February 6, 2026

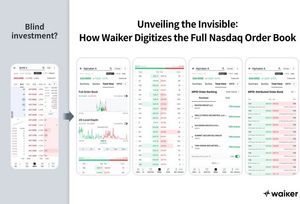

United States, February 6, 2026 -- Waiker Partners with Nasdaq to Deliver Full-Depth Order Book Data to Korean Investors

Via Press Release Distribution Service · February 6, 2026

Alphabet is doubling its capex spend to $175 billion-$185 billion this year.

Via The Motley Fool · February 5, 2026

There might be a key risk hiding in Nvidia's upcoming 10-K filing with the Securities and Exchange Commission.

Via The Motley Fool · February 5, 2026

It is hard to believe that the S&P 500 is only 2–3% below its all-time high, given the carnage across various parts of the market.

Via Talk Markets · February 5, 2026

The U.S. economy has officially entered a new phase of high-octane efficiency, according to the latest data released by the Bureau of Labor Statistics. In a report that has sent ripples through the global financial markets this February 5, 2026, nonfarm productivity was revealed to have surged at a

Via MarketMinute · February 5, 2026

Clearwater Analytics delivers SaaS solutions that streamline investment data management for institutional clients worldwide.

Via The Motley Fool · February 5, 2026

As of early February 2026, the long-standing dominance of high-growth technology and artificial intelligence (AI) stocks has hit a significant wall, triggering a massive "Great Rebalancing" across the U.S. financial markets. Investors, once captivated by the promise of infinite AI scaling, are now rotating aggressively into defensive and value-oriented

Via MarketMinute · February 5, 2026

Buy now, pay later company Affirm (NASDAQ:AFRM) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 29.6% year on year to $1.12 billion. Its GAAP profit of $0.37 per share was 39.5% above analysts’ consensus estimates.

Via StockStory · February 5, 2026

The S&P 500 has reached a pivotal juncture in early 2026, pushing toward the historic 6,144-point milestone, a level that has become a lightning rod for technical analysts and institutional strategists alike. This push to record highs comes at a paradoxical moment for Wall Street; while the headline

Via MarketMinute · February 5, 2026

Via MarketBeat · February 5, 2026

The global economic landscape has been jolted in the opening weeks of 2026 as the United States government formalizes a series of aggressive 25% tariff proposals targeting the critical sectors of semiconductors, automobiles, and pharmaceuticals. These measures, framed as essential for national security and domestic industrial revitalization, have sent shockwaves

Via MarketMinute · February 5, 2026

SANTA CLARA, CA — As of February 5, 2026, the landscape of the artificial intelligence data center market has been fundamentally redrawn. Advanced Micro Devices (NASDAQ: AMD) has successfully completed its integration of ZT Systems, a $4.9 billion acquisition that marked the company's most aggressive move to date to dismantle

Via MarketMinute · February 5, 2026

Tesla, Inc. (NASDAQ: TSLA) has officially signaled the end of its era as a mere high-volume electric vehicle manufacturer, reporting Q4 2025 earnings that exceeded analyst expectations while simultaneously doubling down on Elon Musk’s artificial intelligence ambitions. The company confirmed a strategic $2 billion investment into xAI, the artificial

Via MarketMinute · February 5, 2026

The honeymoon phase of the artificial intelligence revolution has officially ended, replaced by a cold, hard era of fiscal scrutiny. In its latest quarterly earnings report on January 28, 2026, Microsoft (NASDAQ:MSFT) stunned the market not with a lack of ambition, but with a record-shattering $37.5 billion in

Via MarketMinute · February 5, 2026

Global satellite communications provider Viasat (NASDAQ:VSAT) missed Wall Street’s revenue expectations in Q4 CY2025 as sales rose 3% year on year to $1.16 billion. Its non-GAAP profit of $0.79 per share was significantly above analysts’ consensus estimates.

Via StockStory · February 5, 2026

Meta Platforms (NASDAQ: META) has fundamentally rewritten the playbook for Big Tech growth, pivoting from its celebrated "Year of Efficiency" into a massive "Scaling Phase" defined by unprecedented capital expenditure. Following a blockbuster Q4 2025 earnings report that saw revenue climb 24% to $59.9 billion, the company stunned Wall

Via MarketMinute · February 5, 2026

SANTA CLARA, Calif. — In a financial performance that has become the definitive pulse-check for the global technology sector, Nvidia (NASDAQ: NVDA) recently delivered a record-shattering earnings report that effectively silenced skeptics of the artificial intelligence (AI) revolution—at least for now. The semiconductor giant posted a staggering $39.3 billion

Via MarketMinute · February 5, 2026

Pet products provider Bark (NYSE:BARK) fell short of the markets revenue expectations in Q4 CY2025, with sales falling 22.1% year on year to $98.45 million. Its non-GAAP loss of $0.03 per share was $0.01 above analysts’ consensus estimates.

Via StockStory · February 5, 2026

Private markets investment firm StepStone Group (NASDAQ:STEP) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 140% year on year to $586.5 million. Its non-GAAP profit of $0.65 per share was 4.7% above analysts’ consensus estimates.

Via StockStory · February 5, 2026

Digital Realty's data center business is booming as the AI market expands.

Via The Motley Fool · February 5, 2026

Shares of software supply chain platform JFrog (NASDAQ:FROG) fell 8.5% in the afternoon session after the "AI replacement" narrative reached a fever pitch following the release of new models from Anthropic and OpenAI.

Via StockStory · February 5, 2026

Shares of healthcare distributor and services company Cardinal Health (NYSE:CAH)

jumped 10.1% in the afternoon session after the company reported better-than-expected fourth-quarter financial results and raised its full-year earnings guidance.

Via StockStory · February 5, 2026

Shares of wireless chipmaker Qualcomm (NASDAQ:QCOM)

fell 7.8% in the afternoon session after the company issued disappointing revenue and profit guidance for its upcoming quarter, overshadowing an otherwise solid earnings report.

Via StockStory · February 5, 2026