iShares 7-10 Year Treasury Bond ETF (IEF)

96.58

+0.14 (0.15%)

NASDAQ · Last Trade: Dec 29th, 5:08 PM EST

Wharton's Jeremy Siegel Flags Three Near-Term Bumps For 2026 But Maintains Positive Outlook: Reportstocktwits.com

Via Stocktwits · December 29, 2025

Pending Home Sales Rise To Highest Levels In Nearly Three Years: NAR Chief Economist Says ‘Homebuyer Momentum Is Building’stocktwits.com

Via Stocktwits · December 29, 2025

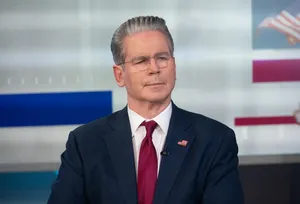

Trump's Former Economic Advisor Says He's Not A Big Fan Of Tariffs, But Adds Economy Doing 'Much, Much Better': Reportstocktwits.com

Via Stocktwits · December 29, 2025

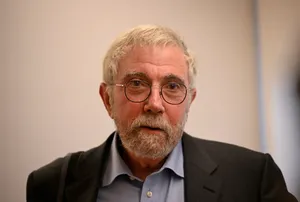

Krugman pointed out that small businesses were unable to weather the storm brought about by the Trump administration’s tariffs and immigration policy changes.

Via Stocktwits · December 29, 2025

Earlier this month, the Bureau of Economic Analysis reported that the U.S. economy grew at an annualized rate of 4.3%, higher than the Dow Jones forecast of 3.2%.

Via Stocktwits · December 29, 2025

Treasury Yields Hold Steady As Wall Street Braces For ‘Considerably Slower’ Q4 GDPstocktwits.com

Via Stocktwits · December 26, 2025

Fed's Williams Sees No Urgency To Cut Rates Again, Says November CPI Was 'Distorted' Downward Due To Technical Factors: Reportstocktwits.com

Via Stocktwits · December 19, 2025

El Erian Sees A New ‘Unsettling’ Economic Risk Emerging In 2026 – And It’s Not Inflation Or Affordabilitystocktwits.com

Via Stocktwits · December 19, 2025

While Trump administration officials continue to back lower rates, market expectations point to the Fed taking a pause next month.

Via Stocktwits · December 24, 2025

According to data released by the U.S. Department of Labor on Wednesday, jobless claims fell by 10,000 to 214,000 in the week ended December 20.

Via Stocktwits · December 24, 2025

He argued that sustained supply-side improvements could contain inflation, despite solid GDP growth.

Via Stocktwits · December 24, 2025

The strategist also pointed to strong consumer spending in the third quarter despite a cooling labor market.

Via Stocktwits · December 24, 2025

November Jobs Report: Payrolls Beat Estimates, But Unemployment Ticks Higherstocktwits.com

Via Stocktwits · December 16, 2025

The economist stated that a cooling of inflation gives the Federal Reserve more room to lower the policy rate further.

Via Stocktwits · December 23, 2025

Miran stated that while he does not see a recession right now, the neutral rate of interest has been brought down because of a “variety of shocks” to the U.S. economy.

Via Stocktwits · December 22, 2025

Conducted at President Trump’s residence, Waller’s interview was concluded before the President’s address to the nation on Wednesday night.

Via Stocktwits · December 19, 2025

Waller now has a 26% chance of being nominated by President Trump to serve as Fed Chair.

Via Stocktwits · December 17, 2025

According to the platform data, Warsh has a 48% chance of being nominated by President Trump for the Fed Chair position, while Hassett ranks second at 38%.

Via Stocktwits · December 16, 2025

The economist said Powell’s tone on inflation, acknowledgment of labor market softness, and the shift on the balance sheet point to a more accommodative direction.

Via Stocktwits · December 16, 2025

Goolsbee was one of the three Fed officials who dissented against the central bank’s decision of a 25-basis-point rate cut on Wednesday.

Via Stocktwits · December 12, 2025

According to data released by the U.S. Department of Labor on Thursday, jobless claims rose by 44,000 to 236,000 in the week ended December 6.

Via Stocktwits · December 11, 2025

According to a CNBC report, Bessent will propose a new approach for the FSOC in a bid to allow the monitoring body to adopt a freer process when it comes to the regulation and oversight of institutions under its mandate.

Via Stocktwits · December 11, 2025

The move marks the third reduction in 2025, following similar quarter-point cuts in September and October.

Via Stocktwits · December 10, 2025

The Employment Cost Index rose 0.8% in the quarter ended September 2025 compared to 0.9% in the previous quarter.

Via Stocktwits · December 10, 2025

According to data from the CME FedWatch tool, there is an 87.6% probability of a 25 bps rate cut on Wednesday.

Via Stocktwits · December 10, 2025